37+ wyoming vehicle sales tax calculator

Before-tax price sale tax rate and final or after-tax price. With 2290 Online You Can File Your Heavy Vehicle Use Tax Form in just 3 Easy Steps.

Used Audi A7 For Sale In Cheyenne Wy Cargurus

Web Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

. After 65 days additional penalties and interest will be. 20000 Sales Tax Rate4 Trade-In Amount. The total tax rate also depends on your county and local taxes which can bring the combined.

Web Calculate Car Sales Tax in Wyoming Example. Keller is An IRS-Approved E-File Provider. Web The Treasurer collects all sales tax due and fees based on place of residence.

However some areas can have a higher rate depending on the local county tax of the area the. Web Sales tax. This calculator just provides an estimate of costs based on the information.

Web Payment of Sales Tax on Motor Vehicles. Get Your Offer Online or In Store Take up to 7 Days to Compare Your Options. Jackson WY 83001 Directions Phone.

Web In Wyoming the state sales tax rate of 4 applies to all car sales. Ad CarMax Offers You an Easy and Reliable Way to Sell or Trade In Your Car. Web Vehicle Registration Calculation Do not use commas or spaces when entering the factory cost.

At 4 the states. Paid the first time a vehicle motorized or non-motorized is registered. Fast Easy Tax Solutions.

Sales tax applies where the purchase of the. Wyoming has no state income tax. Interest will also be charged at 1 per month or any fraction of a month.

Web SALES TAX CALCULATOR Wyoming Sales Tax must be paid to the County Treasurer within 65 of the date of purchase. Web The county Treasurer collects sales or use tax on all vehicle purchases except motorcycles that are bought through a Wyoming Dealer. Ad CarMax Offers You an Easy and Reliable Way to Sell or Trade In Your Car.

Its Quick Easy. Overview of Wyoming Taxes. Purchases a vehicle in Denver 7 the purchaser would pay 5.

Web Sales tax is due in 65 days. 5 6 from April 1 2013 through November 30 2015. Web If payment occurs on day 66 or thereafter the penalty will be the greater of 25 or 10 of the tax due.

Get Your Offer Online or In Store Take up to 7 Days to Compare Your Options. Web For example if someone from Converse County. Web Wyoming Sales Tax Calculator You can use our Wyoming Sales Tax Calculator to look up sales tax rates in Wyoming by address zip code.

The calculator will show you the. Web Wyoming Income Tax Calculator. Penalties will begin collecting a 1 per month interest fee starting with the 66th day and a civil fee of the greater of 2500 or 10 of the tax.

Ad Find Out Sales Tax Rates For Free. Wyoming sales tax must be paid to the County Treasurer within 65 days of the date of purchase. Sales tax on motor vehicles is due within 65 days of the date of purchase or penalties and interest will be assessed by the County.

Web 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

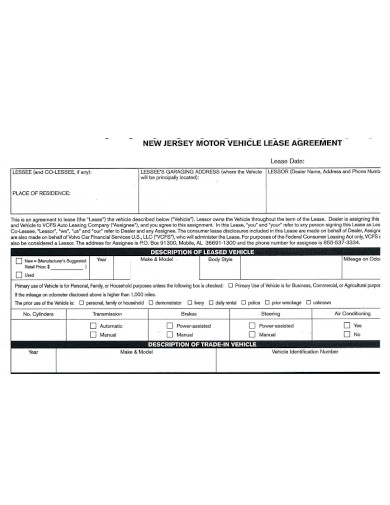

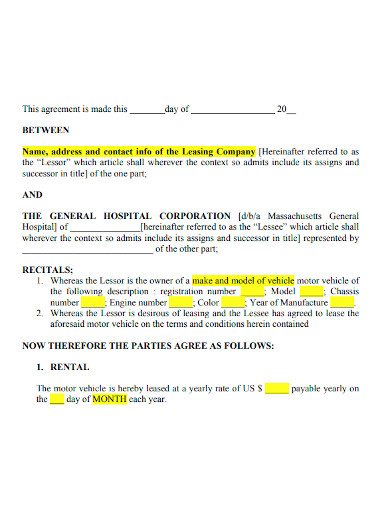

Free 3 Motor Vehicle Lease Agreement Samples In Pdf

21750 Scott Road Peyton Co 80831 Compass

Eca Review 2018 05 16

Highlights Of The North Carolina Public School Budget 2018

00 Mueschke Road Road Hockley Tx 77377 Zerodown

Free 3 Motor Vehicle Lease Agreement Samples In Pdf

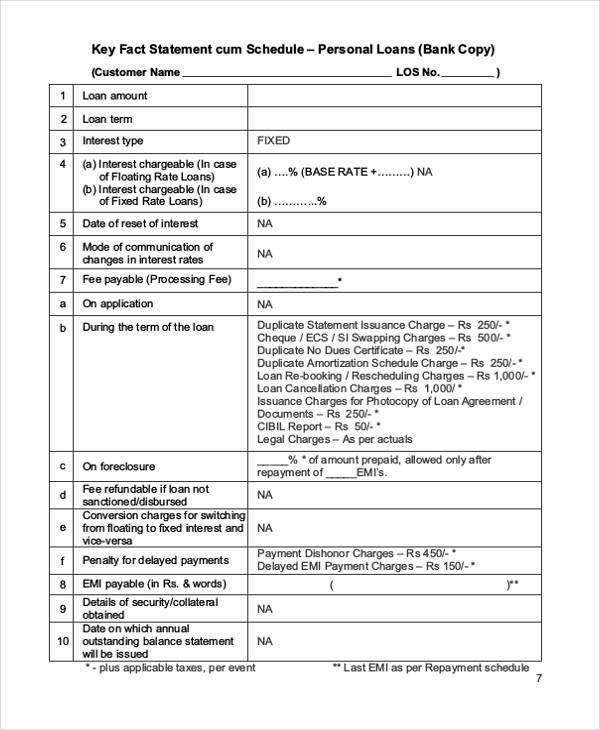

Free 37 Loan Agreement Forms In Pdf Ms Word

201 N Wolcott Street Casper Wy 82601 Mls 20205221 Wywar

Dw Rjb Wcp Petition 1 Pdf Fund Accounting Internal Control

4 Cliffwood Ln Falmouth Ma 02540 Zerodown

36 Elm Avenue Larkspur Ca 94939 Compass

Free Employer Responsibilities For Payroll Taxes With Samples

Taxes And Spending In Nebraska

2941 Marina Drive Alameda Ca 94501 Compass

Sales Tax Calculation Uinta County Wy Official Website

1600 Wyoming Avenue El Paso Tx 79902 Mls 864479 Txgepaor

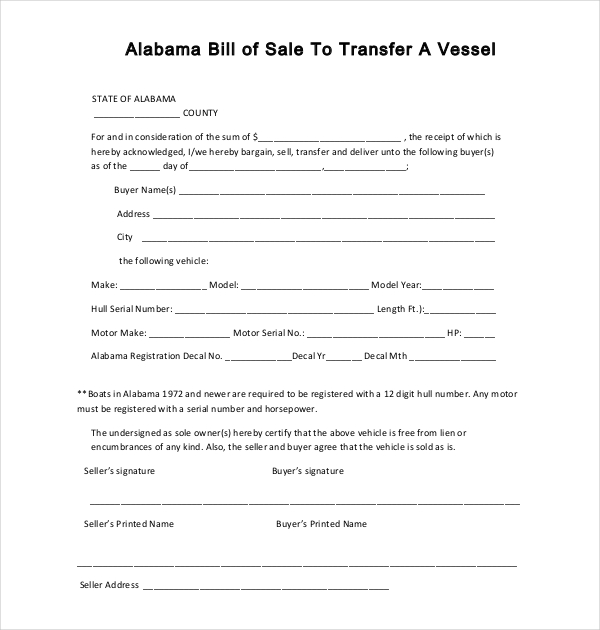

Free 15 Sample Boat Bill Of Sale Forms In Pdf Ms Word